The UK’s first digital mortgage lender

We make getting a buy-to-let home quicker and simpler. Check EligibilityCovid-19 UpdateWhy get a digital mortgage?

We combine smart technology with top partners to offer you a safer and easier process and a better overall experience.

1. Fast

Get your Decision in Principle in minutes.

Full Application reviews can be processed in 24h.

2. Clear

More transparency on your status

during and after your application.

3. Simple

Smart integrations with RightMove

and Experian simplify our process

A recognised innovator

We are proud to be part in a fintech docuseries produced by BBC StoryWorks for Innovate Finance.

Eligibility Criteria

Check our current criteria to get a buy-to-let mortgage with Molo.

Individual

Buy-to-let purchase or remortgage only

We don’t yet offer residential mortgages.

No portfolio landlords

You must not already have 4 or more mortgaged buy-to-let properties.

Property must be in England or Wales

We don’t yet provide mortgages for Scotland.

Limited Companies (SPV)

Special Purpose Vehicles (SPV) limited companies only

Must be a Real Estate SPVs registered within England or Wales.

The SIC Code must be 68100 or 68209

No other SIC codes will be accepted.

Maximum of 4 directors or shareholders

Each director or shareholder must provide a full personal guarantee.

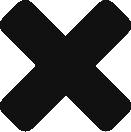

How it Works

Here’s what you need to do to get your mortgage in minutes.

As seen on:

Find out more

Find out more about getting a buy to let mortgage loan with Molo.

How much can I borrow for my buy to let mortgage?

To check how much you could borrow, check our mortgage calculator: insert link here.

You’ll be able to use the calculator to check for a mortgage loan as an individual or as a limited company.

Can I get a 'consumer buy to let' mortgage with Molo?

“Consumer Buy to Let” are mortgage contracts that are regulated by the Financial Conduct Authority to protect accidental landlords.

Buying a property to rent out will never be classed as Consumer Buy to Let, but if you already own a property that you intend to now rent out, it will be classed as Consumer Buy to Let if:

- You have no other properties that are currently rented out to non family members; and

- You or an immediate family member have never lived in the property since owning it

If these circumstances apply to you, your loan may be classed as “Consumer Buy to Let” and at present, Molo will be unable to offer you a loan.

Are you a broker? Do I need one to get a mortgage loan with Molo?

We are not a broker, but a lender. With Molo, you can actually get a mortgage directly without having to interact with an intermediary who may charge you a separate fee.

Do you also offer residential mortgages?

We’re working on our residential products now, but launch timings are dependent on two things – ongoing conversations with the regulators, and lots of customer testing.

If you are interested, sign up to https://www.molofinance.com/signup and you’ll be the first to hear when it’s coming.

Get a Decision in Principle in minutes

Find out how much money you could borrow from Molo.

DIGITAL MORTGAGE

How it Works

Eligibility

Customer Reviews

All services are provided by Molo Tech LTD (registered number 10510180.) Molo Tech LTD is registered in England with registered office at 84 Eccleston Square, Pimlico, London SW1V 1PX.

Molo Tech LTD is not regulated by the PRA but has voluntarily adopted the PRA's Supervisory Statement (SS 13/16) on underwriting standards for buy-to-let mortgage contracts.

Privacy Policy

Cookie Policy

Terms & Conditions